The Novozymes stock is listed on Nasdaq Copenhagen and included in the OMX Copenhagen CAP 20 index.

Shareholders

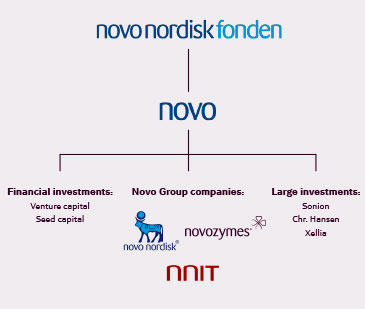

Novozymes' common stock consists of two types: A shares and B shares, both with a nominal value of DKK 2 per share. All A stock is held by Novo A/S, and an A share carries 10 times as many votes as a B share. At the end of 2016, Novo A/S held 25.75% of the total common stock and, through its holding of the A stock and a proportion of the B stock (26,071,400 shares), controlled 71% of the votes. Novo A/S, domiciled in Hellerup, Denmark, is wholly owned by the Novo Nordisk Foundation, and Novozymes is therefore included in the consolidated financial statements of the Novo Nordisk Foundation.

At year-end, Novozymes had more than 60,000 shareholders, of whom more than 95% were private shareholders in Denmark. Forty institutional investors, including Novo A/S, owned approximately 50% of the B shares. Around 65% of the B shares were held outside Denmark. Novozymes held 4.9% of the B stock, equivalent to 4% of the total common stock.

Novo A/S was the only major stockholder holding more than 5% of Novozymes' common stock on December 31, 2016.

Stock performance

Novozymes' share price contracted by 26% during the year. In comparison, the OMXC20CAP fell by 2% in 2016.

The average daily trading volume of Novozymes' stock in 2016 was 826,589 shares, or DKK 141 million, making it the 10th most actively traded company on Nasdaq Copenhagen, compared with ninth in 2015. At year-end, the total market cap of Novozymes was DKK 75.5 billion, split between DKK 62.4 billion for the B shares and DKK 13.1 billion for the nontraded A shares, assuming the same value per share as for the B shares.

Over the past five years, Novozymes' stock has generated an average annual return (compounded) to shareholders of 8%. Total shareholder return in 2016 was a negative 25%, adjusted for dividends.